In today’s economic landscape, rising inflation has become a major concern for most people and certainly for families. The ever-increasing cost of goods and services is no joke. But do you know how homeownership helps protect you from inflation?

Due to the cost and the significant impact on all of our day-to-day lives, most renters write off the possibility of buying a house and homeownership and choose the wait-and-see approach. I get it, a lot of people are reevaluating their big-ticket purchases, such as buying a home, to determine whether it’s still a viable option or if they should wait for more favorable conditions.

In this article, we will explore how homeownership can help you combat the rising costs associated with inflation and provide stability and security for your financial future. Here are 6 ways homeownership helps protect you from inflation.

Homeownership Offers Stability and Security

During periods of high inflation, prices tend to rise across the board. This includes not only everyday items like food and entertainment but also housing costs. Both rental prices and home prices are on the rise, making it crucial to find ways to protect yourself from increasing expenses. One of the most effective ways to achieve this is through homeownership. Here’s why…

When you buy a home, you have the opportunity to stabilize your housing costs, which are typically the largest monthly expense for most individuals. By securing a fixed-rate mortgage, you can lock in a consistent monthly payment for the duration of your loan, whether it’s 15 or 30 years.

“A fixed-rate mortgage allows you to maintain the biggest portion of housing expenses at the same payment. Sure, property taxes will rise and other expenses may creep up, but your monthly housing payment remains the same.”

James Royal, a Senior Wealth Management Reporter – Bankrate

While other prices may continue to rise, your housing payment remains a steady, reliable, and predictable amount, helping you maintain control over your budget. This stability can be a significant advantage compared to renting, where you are at the mercy of rising housing costs.

Oregon just announced the rent increase cap for 2023 is 14.6%. Do the math… That means a house currently renting for $1,500/mo. could potentially see an increase of $219.00/mo. in 2023. You see, rents will always increase, that’s one-way homeownership helps protect you from inflation… simply by having a fixed rate mortgage.

Use Home Price Appreciation to Your Benefit

Although rising mortgage rates and home prices have made buying a house more expensive than it was a year ago, there are still opportunities to set yourself up for long-term success. By purchasing a home now, you can lock in today’s rates and prices before they climb even higher.

Will rates go up or down? Who knows, that depends on the Feds and the inflation rate. But what is certain is that over time, home values go up, not down, and during inflationary times, it is crucial to invest your money in assets that traditionally hold or appreciate in value.

During inflationary times, it is crucial to invest your money in assets that traditionally appreciate in value.

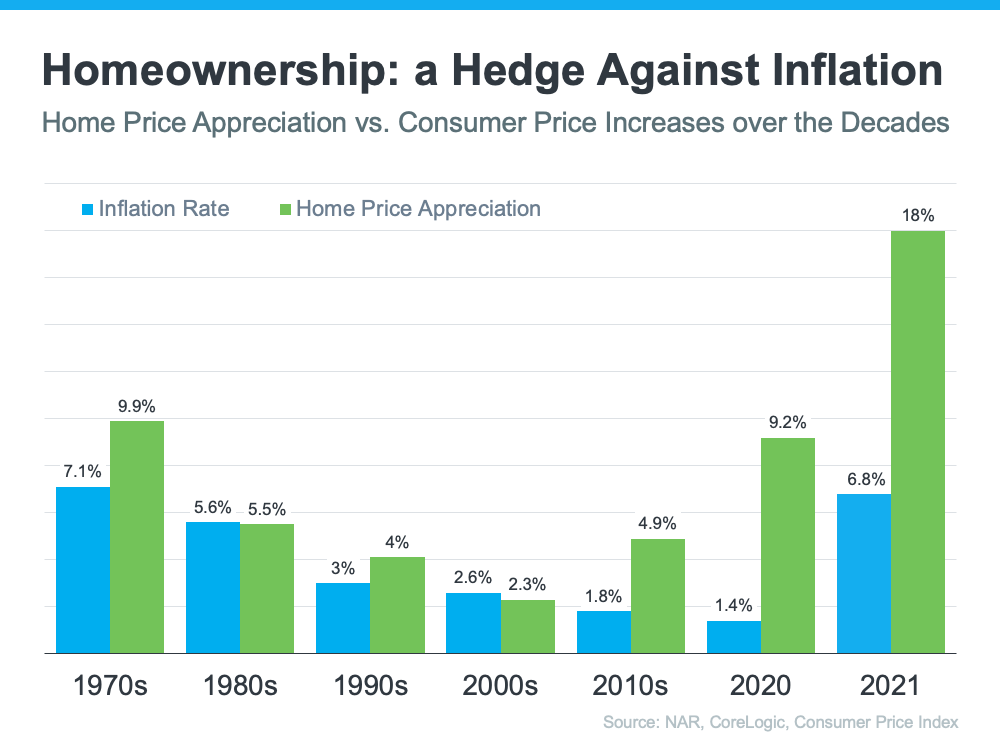

Real estate, specifically homeownership, has proven to help shield you from inflation throughout history. The graph below shows how home price appreciation has outperformed inflation in most decades since the 1970s. You’ll see that even with the market crash of 2008, homeownership still wins as a protection against inflation.

One thing you can easily notice is that home prices have consistently increased, even during inflationary periods. By purchasing a home now, you can potentially benefit from future home price appreciation, which not only enhances your equity but also contributes to your overall net worth.

Another thing to consider… the ongoing supply and demand imbalance in the housing market suggests that home prices will continue to rise in the foreseeable future, making homeownership a wise investment now. And, if you’re unhappy with the rates because you remember the 3% days, you’re not alone.

But history shows us that waiting will ultimately cost you more in the long run. By buying a home now, you lock in your rate and payment and avoid future price increases, but you have the flexibility of refinancing your house later if rates come down.

Building Wealth and Financial Security

Aside from the immediate benefits of stability and potential appreciation, homeownership also helps protect you from inflation by offering long-term advantages in building wealth and financial security. When you own a home, each mortgage payment you make contributes to your equity. In fact, according to a study by the National Association of REALTORS, homeowner wealth is 40 times higher than renters on average.

Homeowner wealth is 40X higher than renters.

Melissa Dittmann Tracey – NAR

Your home equity is an easy calculation… it’s the difference between your home’s value and the remaining mortgage balance. As you pay down your mortgage over time, your equity grows, providing you with a valuable asset. This is why I recommend that homeowners get an updated home evaluation annually.

Moreover, as your home’s value appreciates, your equity increases even more. This accumulated wealth can be leveraged in various ways, such as tapping into home equity for renovations, education expenses, real estate investing, or other financial needs. Additionally, owning a home can provide a sense of security and peace of mind, knowing that you have a valuable asset that can weather economic fluctuations.

Tax Advantages of Homeownership

Another way homeownership helps protect you from inflation is the potential tax benefits it offers. While tax laws and regulations vary state by state, Oregon provides tax incentives to encourage homeownership. Did you know that in the United States, homeowners can deduct mortgage interest and property taxes from their annual income taxes, effectively reducing their taxable income?

These deductions alone can result in significant savings, particularly for homeowners with higher mortgage amounts and property taxes. Definitely worth factoring into your rent vs. buy decision.

What about when you sell? Well, if you decide to sell your home in the future, you may be eligible for capital gains exclusions, allowing you to exclude a portion of the profit from the sale of your primary residence from your taxable income. These tax advantages can further enhance the financial benefits of homeownership and provide additional protection against inflation.

Long-Term Planning and Wealth Accumulation

One of the key advantages of homeownership is its potential for long-term planning and wealth accumulation. Unlike renting, where your monthly payments go towards someone else’s investment, homeownership allows you to build equity and wealth over time. As you make mortgage payments, you are essentially paying yourself by increasing your ownership stake in the property.

Furthermore, homeownership provides opportunities for leveraging your accumulated equity. You can consider refinancing your mortgage to take advantage of lower interest rates or use a home equity loan or line of credit to finance other investments or expenses. These options can help you optimize your financial situation and make the most of your homeownership journey.

Diversification and Portfolio Allocation

In addition to its wealth-building potential, homeownership also offers diversification benefits and can serve as a strategic component of your investment portfolio. Owning real estate provides exposure to a different asset class, which may have unique risk and return characteristics compared to traditional investments like stocks and bonds.

Including real estate in your investment portfolio can help diversify risk and potentially enhance overall portfolio performance. Historically, real estate has shown a low correlation with other asset classes, meaning that its performance does not necessarily align with the fluctuations of the stock market or other investments. This diversification can help mitigate risk and provide stability during volatile economic periods.

Considerations for First-Time Homebuyers

While homeownership can offer many advantages in combating inflation and building wealth, it is essential to consider your individual circumstances before making a decision. First-time homebuyers, in particular, should take into account factors such as their financial readiness, job situation, long-term plans, as well as the local housing market conditions.

It is crucial to assess your financial situation, including your income, savings, and credit score, to ensure that you can comfortably afford homeownership. The first thing you should do when thinking about buying your first house is to ask for help. You’ll want to talk to a local real estate broker, (contact me here) as well as a mortgage professional.

Additionally, carefully evaluate your long-term plans and whether homeownership aligns with your lifestyle and goals. Owning a home requires ongoing maintenance, repair costs, and the commitment to stay in one location for an extended period. If you anticipate frequent relocations or prefer the flexibility of renting, homeownership may not be the best choice for you at this time.

Lastly, research the local housing market conditions and trends. Again, I can help you with that. You can find me on all the major social media channels where I share weekly and monthly market updates. Understanding factors such as supply and demand, home price appreciation rates, and affordability can help you make informed decisions about when and where to buy a home.

Bottom Line

Inflation can pose significant challenges to individuals and families, affecting the affordability of essential goods and services. However, homeownership helps protect you from inflation. Homeownership is a powerful solution to combat rising costs and protect your financial well-being.

By stabilizing housing expenses, leveraging home price appreciation, building wealth, and enjoying potential tax advantages, homeownership provides stability, security, and long-term financial benefits. While careful consideration of personal circumstances and market conditions is essential, homeownership remains a strong investment choice for individuals looking to navigate inflationary periods successfully.

Are you ready to begin your journey toward homeownership and toward a secure financial future? Shoot me a message or email. I’m always here to help.